My last business trip to Portland, Oregon was hard to take. Once a Rosy city (City of Roses) the riots and fires of 2020- 2022 and COVID lock-downs have turned into a bit of Detroit after the riots in 1967.

What is happening in Portland now?

As of November 2023, City of Portland employees were not required to return to work and still working from home. Thousands of businesses have left downtown since 2019. The business district leasing vacancy rate has more than doubled since 2019 and is predicted to increase over the next few years. Manufacturing companies are slowing down, leaving or selling. Distribution centers and the like are coming in. What Catherine Austin Fitts predicted in 2020 when the riots started is coming to pass, Real Estate Stealing.

Mark Childs, Capacity Commercial Group, describes Portland, SW Washington changes in his Industrial Newsletters. Businesses are moving to the suburbs or out of state. “Regional companies are vacating our market and supporting their operations from other locations, and local companies are throwing in the towel if they happen to be in one of the market segments that the Feds are trying to bust. Additionally, we are hearing that the 3PL folks (a large part of our industrial market) are having some tough times with decreasing volumes. This is in part due to the general economy, but also in part due to the global shipping economy.”

The problems and challenges are deep and far reaching.

Gifts given by the Federal Government during COVID seem a pittance now. Bottom line, all industry sectors are impacted by COVID and post ramifications, especially in west coast cities and beyond.

During meetings with clients and colleagues, I learned of Johnson and Johnson, Boston Scientific, and other medical device company layoffs or “delayed or on indefinite hold” projects, and of partnerships of those companies with Chinese National partners. Vexos, a leading global Electronic Manufacturing Services (EMS) and Custom Material Solutions (CMS) acquired Controltek in Vancouver, WA. Fabrication companies in the Portland Metro area were struggling to keep employees working and, in some cases, taking work share assistance from the state. Later in the month Ascentron, another family-owned EMS/CMS company in Medford OR was acquired.

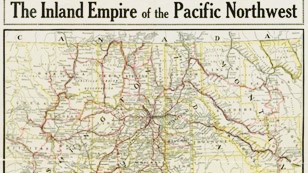

East Side of the Cascades- How’s it going?

Businesses on the east side of the mountains are doing much better and thriving. The community in Boise, Coeur D’ Alene, and Spokane is energized and open. But behind the scenes businesses are fighting some of the same forces that devastated west coast cities including Portland, San Francisco, and Seattle; regulations and taxation, work force quality and scarcity, continuing supplier and supply chain challenges and changes, crime and homelessness, and new geopolitical threats.

These forces bring significant risk to operations and profitability. The risks have escalated in the past four years and are begging for more attention and action. In most business meetings or events, these factors and risks are the Elephant in the room and not discussed.

Many businesses do not plan to address risk and or mitigation. They go gangbusters in good times with revenue and profit seeping through the cracks and wondering what hit them during down times. Businesses limp along without a tactical plan to execute strategy and address issues and risks.

The Mervyn Group is passionate about helping businesses thrive under what have become harrowing conditions. As in the Dark Ages, businesses will be the key to the turnaround of urban cores and a new Renaissance. Businesses have everything at stake and will fight to defend what they have. Relocation is expensive. Rehiring and retraining again and again is expensive. Over regulation and taxation are crushing.

Solutions- Pain and the Gain

Over the next few months, we will provide the top systems which improve operations, delivery, quality, and bottom-line performance (good time or bad) and how these address Elephants in the room. We will describe the pain associated with gaps in these systems and the benefits of improvements. Here is a preview of some:

- Tactical planning and management to implement strategic goals and objectives.

- Understanding systems and true cost of goods/ services and planning for improvements.

- Work Force education, training, and retention program development.

- Standard processes documentation and refinement (Quality/ Business Management Systems)

- Regulation management

- Suppliers and supply chain management

- Product development, introduction, and manufacturing launch and sustainability

Contact Debra Mervyn Debra@MervynGroup.com to learn more.

Contract Mark Childs MarkC@CapacityCommercial.com for Oregon and SW Washington commercial real estate data.

Next – Tactical Planning- What value is a Strategy if there are no tactics to execute it?